Part II: Beneficial Ownership Rule – Applying the Fifth Pillar: The When and the How

With less than a month for the mandatory compliance with the Financial Crimes Enforcement Network’s (FinCEN) final beneficial ownership rule

Read More

With less than a month for the mandatory compliance with the Financial Crimes Enforcement Network’s (FinCEN) final beneficial ownership rule

Read More

Despite all of the recent controversy surrounding the Facebook brand and their now infamous data breach affecting upwards of 87 million people

Read More

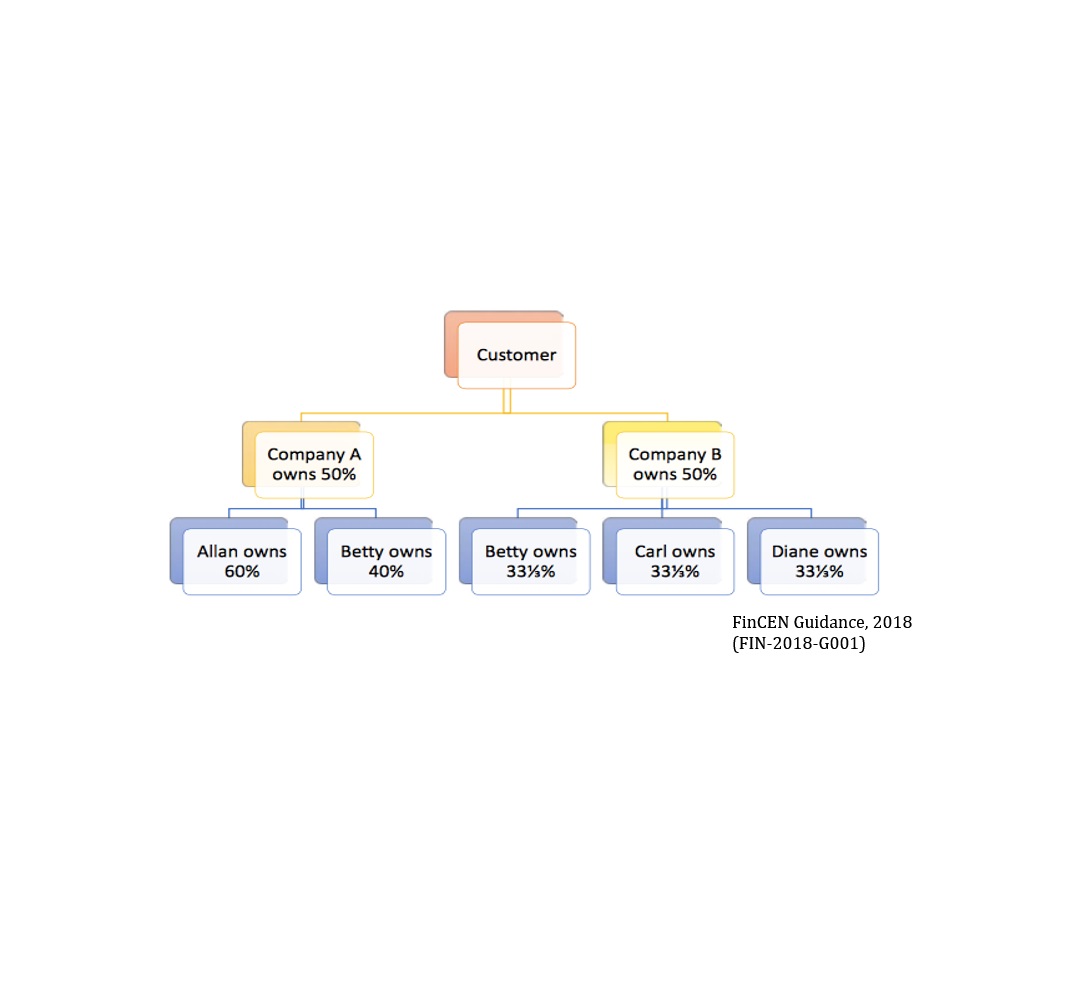

New Customer Due Diligence (CDD) Beneficial Ownership requirements have shifted the focus of compliance to an area that has historically been challenging.

Read More

While financial institutions across the United States have had ample time to wean in any and all alterations needed to ensure their compliance

Read More

Although controversial to this day, the 2015 Iran nuclear deal is widely considered the signature foreign policy move made by Barack Obama

Read More

Over the last six months, talk of Initial Coin Offering’s (ICO’s) and the Bitcoin-boom have shared the spotlight across the financial realm.

Read More

Many of us grew up fans of the timeless board game Monopoly, a game that gave many operating professionally within the financial realm

Read More

Another area of concern stemming from increased scrutiny in the sanctions compliance realm involves de-risking, a hot-button topic across the financial sector

Read More

Customer due diligence is universally recognized as a fundamental process to mitigating illicit finance risk, even though not all financial institutions

Read More

The growth and reliance on technology in the financial realm in recent years has opened new doors for financial service enterprises across the globe

Read More