Court Records Screening

Protect against money laundering

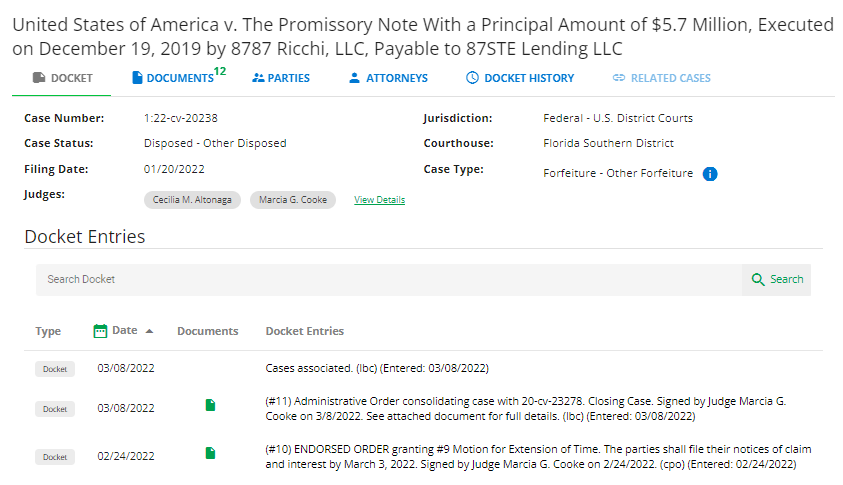

Access state and federal court records for any open and closed litigation for prospect customers, existing clients, borrowers, employees, or vendors.

Global RADAR’s Onboarding & Risk Management Solution provides a single platform that automates the onboarding process, incorporating data from court records, sanctions lists and adverse media to strengthen your due diligence review efforts for all departments within your organization.