FinCEN Targets Chinese Money Laundering Networks in Fight Against Illicit Finance

In a decisive move to safeguard the United States’ financial system and the health of…

Since 2007, we’ve simplified regulatory compliance and anti-money laundering for businesses with cutting-edge risk management tools—keeping you safe and ahead of the curve.

Founded by compliance experts frustrated with outdated tools, Global RADAR was born to make compliance easier for everyone. Our team has decades of experience, so we know exactly what you need—whether it’s cutting through endless paperwork or staying ahead of ever-changing regulations. We’ve been in your shoes, dealing with tight deadlines and complex rules, which is why our software is intuitive, efficient, and custom-fit for your unique business needs.

Picture this: a transaction that looks normal but is part of a money laundering scheme. Our AI spots it instantly, saving you from fines and legal trouble.

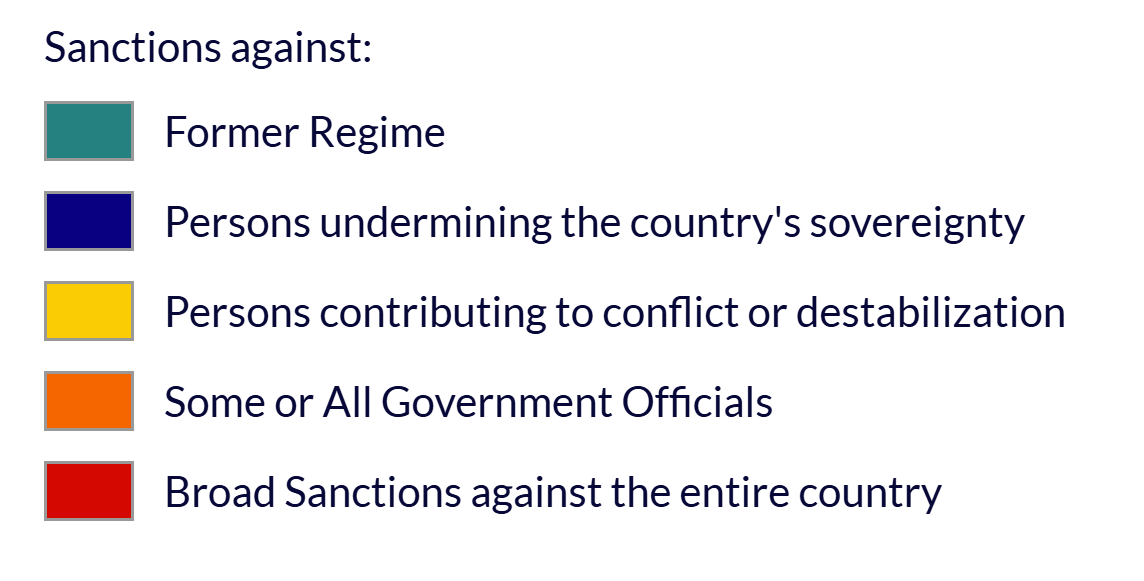

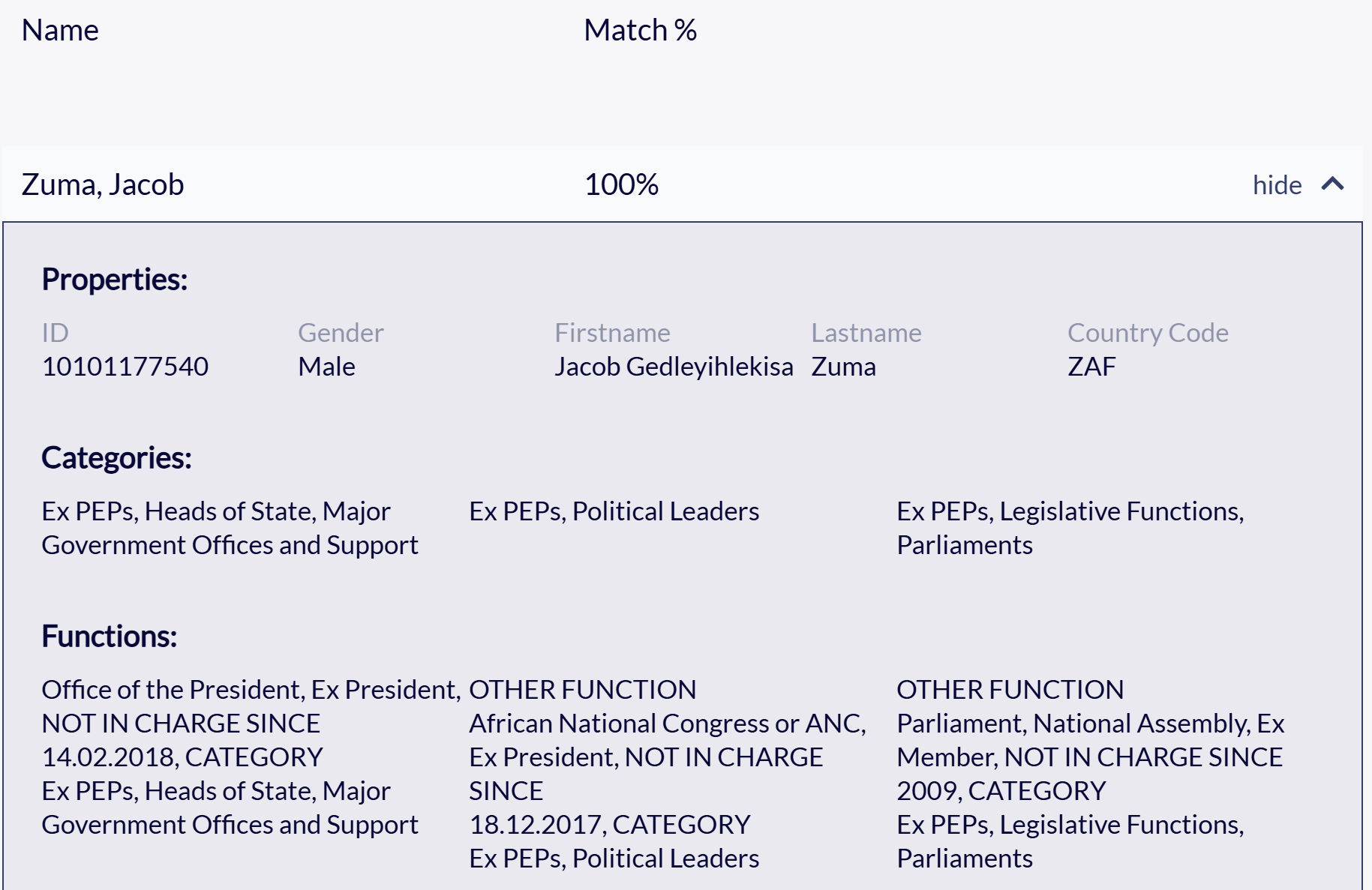

Ever worried about partnering with the wrong entity or individual? Our tools check against global watchlists, so you can do business with confidence.

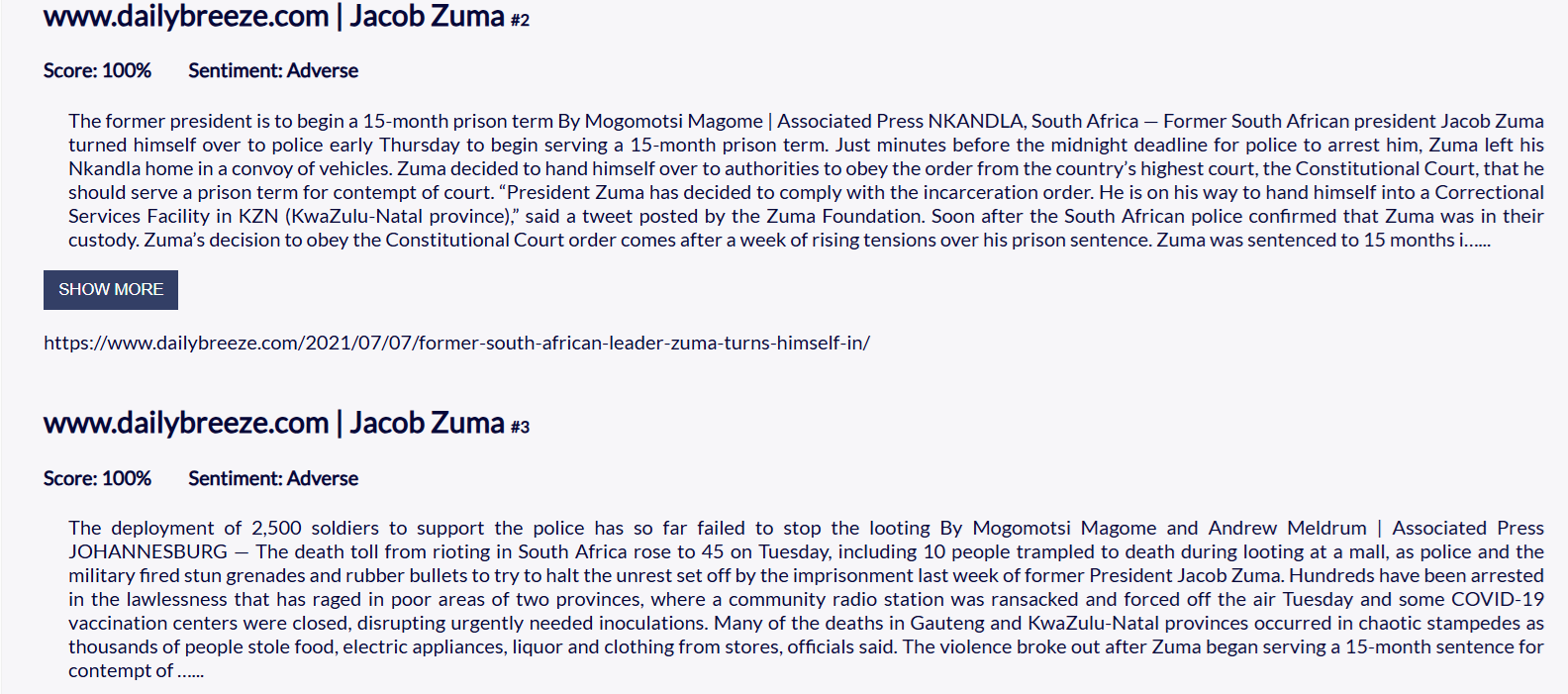

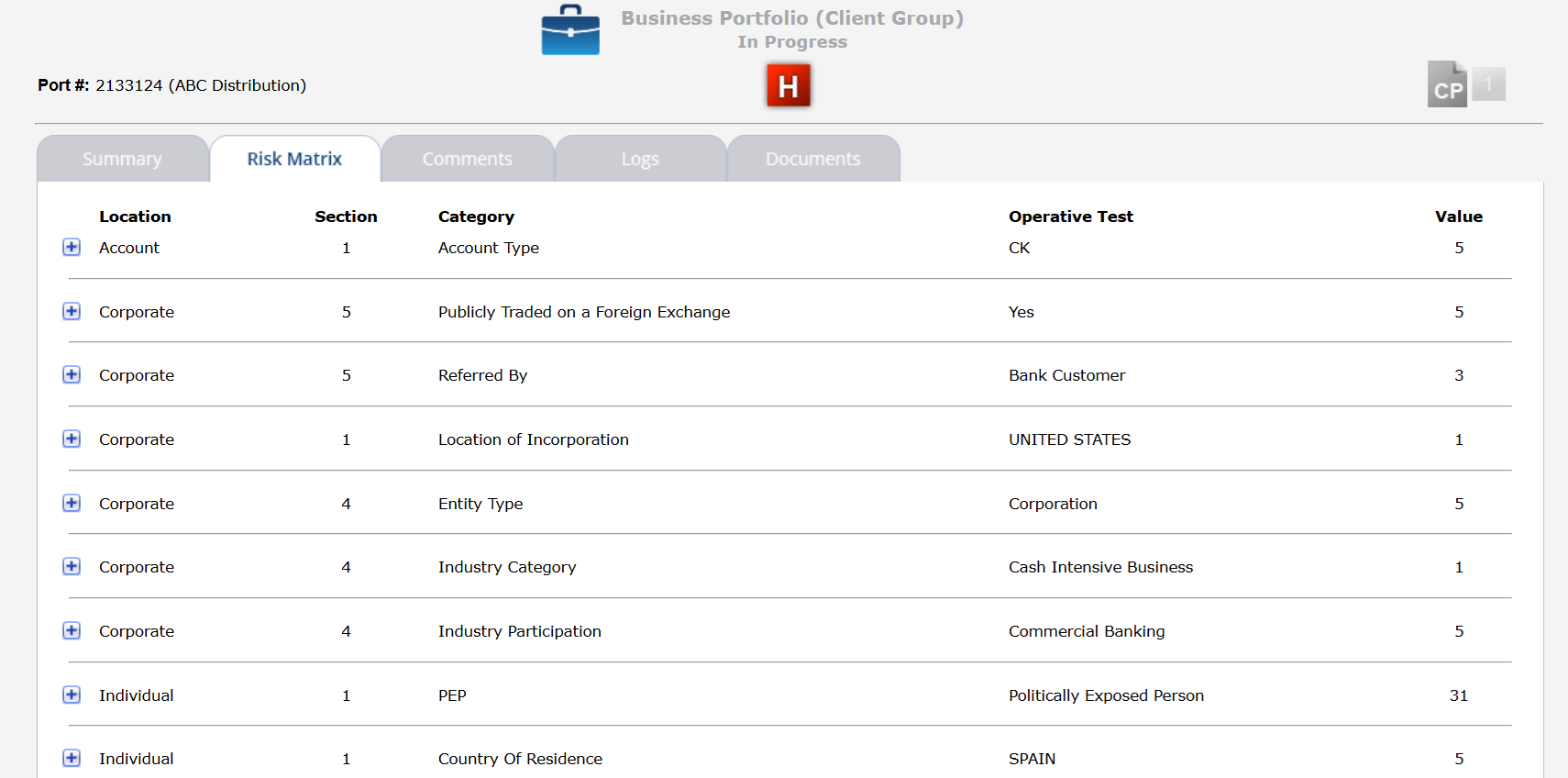

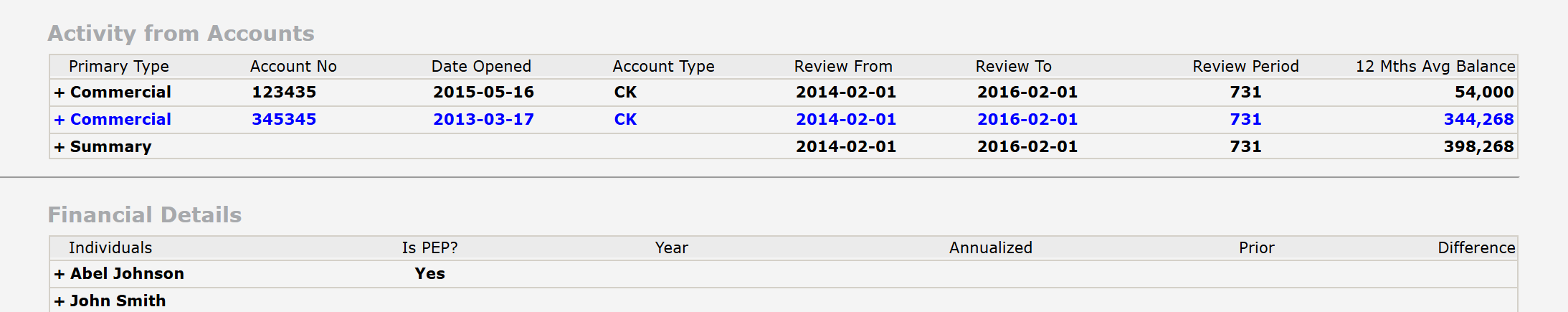

Think you know your client? For high-risk cases, our enhanced due diligence digs deeper—uncovering hidden risks like negative news, country risks, or beneficial ownership, so you can make informed decisions without fear.

Compliance across borders is complex. Our platform simplifies it, letting you focus on growing your business, not on red tape.

Verify identities in seconds with 99.99% accuracy—because you’re dealing with real people, not fraudsters.

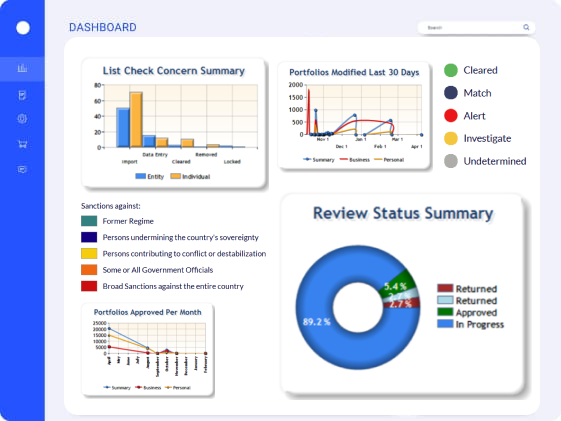

Transform your compliance workflow with our comprehensive suite of solutions:

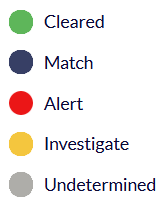

1. Industry-leading watchlist and sanctions screening via web interface or API.

2. Seamless Salesforce integration for compliance checks within your CRM.

3. Enterprise-grade solutions for complex organizational needs to include automated client

onboarding, risk rating, transaction surveillance and workflow management.

4. Sanctions Clearing Services: data cleansing, sanctions screening, clearing and

resolution.

Global coverage to meet your regulatory requirements

Absolutely! Our platform works seamlessly with your current tools, including Core Banking systems, LexisNexis, and Dow Jones. As a content-agnostic solution, we can process data from any provider, enhancing your existing compliance infrastructure without disruption.

In today's regulatory environment, compliance screening is crucial across all industries. Whether you're in healthcare, real estate, technology, or beyond, our customizable platform helps protect your business from regulatory risks and safeguards your reputation.

Hit the ground running with Global RADAR's streamlined implementation process. Our expert team provides hands-on support to ensure a smooth transition, while our intuitive interface enables your team to start benefiting from enhanced compliance workflows immediately.

Experience partnership, not just software. Our compliance experts become an extension of your team, providing strategic guidance, workflow optimization, and ongoing support as regulations evolve. We're invested in your success from day one.

Built by compliance officers for compliance professionals, Global RADAR offers:

1. A unified platform that eliminates the need for multiple systems.

2. Daily-updated content lists for real-time risk assessment.

3. Comprehensive audit trail with timestamps and detailed documentation.

4. Industry-specific expertise since 2007.

5. True partnership approach with dedicated support

Our AI-powered platform is built to simplify compliance for businesses like yours.